All Categories

Featured

Table of Contents

Eliminating representative settlement on indexed annuities enables for significantly higher illustrated and real cap rates (though still markedly reduced than the cap prices for IUL policies), and no uncertainty a no-commission IUL plan would certainly push illustrated and real cap rates higher. As an apart, it is still possible to have a contract that is really rich in representative settlement have high early cash surrender values.

I will acknowledge that it is at least in theory POSSIBLE that there is an IUL policy out there released 15 or 20 years ago that has actually supplied returns that are premium to WL or UL returns (extra on this below), however it is very important to much better comprehend what an appropriate contrast would certainly involve.

These policies usually have one bar that can be set at the business's discretion yearly either there is a cap rate that defines the optimum attributing price because certain year or there is an engagement rate that specifies what portion of any kind of positive gain in the index will be passed along to the plan because specific year.

And while I generally agree with that characterization based on the technicians of the plan, where I take issue with IUL proponents is when they identify IUL as having exceptional returns to WL - maximum funded life insurance. Several IUL supporters take it a step even more and point to "historical" information that appears to support their cases

First, there are IUL plans in existence that lug more threat, and based on risk/reward principles, those policies should have higher anticipated and real returns. (Whether they actually do is a matter for serious debate however companies are using this method to help validate higher detailed returns.) As an example, some IUL plans "double down" on the hedging strategy and evaluate an additional fee on the policy yearly; this fee is after that made use of to enhance the choices budget; and afterwards in a year when there is a positive market return, the returns are amplified.

Iul Dortmund

Consider this: It is possible (and in fact most likely) for an IUL policy that standards an attributed price of say 6% over its very first 10 years to still have a general unfavorable rate of return throughout that time because of high costs. Lots of times, I find that representatives or consumers that brag about the efficiency of their IUL policies are puzzling the attributed rate of return with a return that appropriately reflects all of the policy charges.

Next we have Manny's inquiry. He says, "My good friend has been pushing me to purchase index life insurance and to join her business. It resembles a MLM. Is this a good idea? Do they actually make just how much they say they make?" Let me begin at the end of the concern.

Insurance policy salesmen are tolerable people. I'm not suggesting that you would certainly hate yourself if you claimed that. I stated I utilized to do it, right? That's exactly how I have some understanding. I used to offer insurance coverage at the beginning of my profession. When they market a premium, it's not unusual for the insurance coverage business to pay them 50%, 80%, also in some cases as high as 100% of your first-year premium.

It's difficult to offer because you obtained ta always be looking for the following sale and mosting likely to find the next person. And especially if you do not feel really founded guilty about things that you're doing. Hey, this is why this is the very best solution for you. It's going to be difficult to discover a great deal of satisfaction because.

Let's talk about equity index annuities. These things are prominent whenever the markets are in a volatile period. You'll have abandonment periods, normally 7, 10 years, maybe even past that.

New York Life Variable Universal Life Accumulator

Their surrender durations are big. So, that's just how they know they can take your money and go totally spent, and it will be fine due to the fact that you can't get back to your cash until, once you enjoy 7, 10 years in the future. That's a long-term. Regardless of what volatility is going on, they're probably going to be great from an efficiency point ofview.

There is no one-size-fits-all when it comes to life insurance./ wp-end-tag > In your hectic life, financial freedom can seem like a difficult goal.

Less employers are providing conventional pension strategies and numerous firms have reduced or terminated their retirement plans and your capability to depend entirely on social safety and security is in inquiry. Even if advantages have not been reduced by the time you retire, social protection alone was never intended to be sufficient to pay for the lifestyle you want and should have.

Nationwide Index Universal Life

/ wp-end-tag > As component of an audio financial technique, an indexed global life insurance plan can assist

you take on whatever the future brings. Before devoting to indexed global life insurance coverage, below are some pros and cons to consider. If you choose a good indexed global life insurance strategy, you may see your cash worth grow in worth.

Considering that indexed universal life insurance requires a particular level of threat, insurance policy business tend to maintain 6. This type of plan additionally uses.

If the selected index doesn't do well, your cash value's development will be affected. Usually, the insurer has a vested rate of interest in carrying out better than the index11. Nonetheless, there is usually a guaranteed minimum rate of interest price, so your strategy's development won't drop listed below a specific percentage12. These are all variables to be thought about when selecting the very best kind of life insurance policy for you.

Nevertheless, given that this sort of policy is a lot more intricate and has a financial investment part, it can frequently feature higher costs than other policies like entire life or term life insurance. If you do not assume indexed global life insurance policy is ideal for you, below are some choices to think about: Term life insurance policy is a temporary policy that usually uses insurance coverage for 10 to thirty years.

Iul Retirement

When choosing whether indexed global life insurance policy is ideal for you, it is essential to think about all your options. Entire life insurance policy might be a better option if you are seeking more stability and uniformity. On the various other hand, term life insurance policy might be a better fit if you only need protection for a particular time period. Indexed global life insurance policy is a kind of plan that supplies extra control and flexibility, along with greater cash value development capacity. While we do not provide indexed global life insurance, we can offer you with more details concerning entire and term life insurance plans. We recommend exploring all your choices and talking with an Aflac agent to uncover the very best suitable for you and your household.

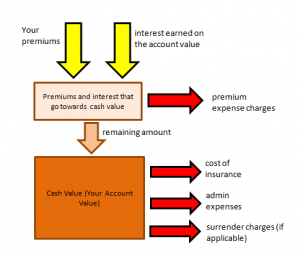

The rest is added to the cash money worth of the plan after charges are deducted. While IUL insurance might show important to some, it's vital to understand just how it functions prior to acquiring a policy.

Table of Contents

Latest Posts

Best Iul Companies 2021

Iul Marketing

Iul Training

More

Latest Posts

Best Iul Companies 2021

Iul Marketing

Iul Training